Top Austin, TX Insurance Companies (33)

Don't see your company?

Create a company profileWe’re a thriving, global online marketplace making the beauty of the outdoors accessible to everyone by mobilizing the over 50 million recreational vehicles that sit idly around the world and connecting them with people craving memorable travel experiences. We help everyone go forth safely in the outdoors by providing insurance through Roamly, the best RV insurance out there.

ePayPolicy is a fast-growing tech company in the heart of Austin. Our payment processor enables insurance professionals to accept electronic payments, & our tech is changing the industry. We are the BEST at what we do, and always encourage ideas & creativity. We're just a fun bunch excited to push the envelope each day! #YouCanWorkWithUs #LetsGo

Acrisure Innovation is a fast-paced, AI-driven team building innovative software to disrupt the $6T+ insurance industry. Our mission is to help the world share its risk more intelligently to power a more vibrant economy. To do this, we are transforming insurance distribution and underwriting into a science. At the core of our operating model is our technology: we’re building the premier AI Factory in the world for risk and applying it at the center of Acrisure, a privately held company recognized as one of the world's top 10 insurance brokerages and the fastest growing insurance brokerage globally. By using the latest technology and advances in AI to push the boundaries of understanding risk, we are systematically converting data into predictions, insights, and choices, and we believe we can remove the constraints associated with scale, scope, and learning that have existed in the insurance industry for centuries. We are a small team of extremely high-caliber engineers, technologists, and successful startup founders, with a diverse background across industries and technologies. Our engineers have worked at large companies such as Google and Amazon, hedge funds such as Two Sigma and Jump Trading, and a variety of smaller startups that grew quickly such as Indeed, Bazaarvoice, RetailMeNot, and Vrbo.

Bestow is the leading digital platform for life insurance. As both a direct-to-consumer destination and an infrastructure provider, Bestow powers instant life insurance solutions for businesses of all sizes, across any channel. In a world full of unknowns, Bestow is on a mission to make life insurance accessible to millions of underserved families by creating the best possible products and experiences that serve future generations.

AWL is one of the most successful customer acquisition marketing companies in the nation. Our focus is the insurance industry and our team uses Internet marketing to turn consumer interest in insurance products into policy sales for the world’s largest insurance carriers and thousands of insurance agents.

Zendrive is a mission-driven start-up focused on making mobility safer and accelerating insurance digital transformation. We've built the world's largest and fastest growing mobile driving analytics platform for measuring and predicting driver risks. Our technology enables auto insurers and mobile apps to deliver safety tools and innovative insurance products to their customers.

Founded in 2015 and headquartered in Austin, TX, The Helper Bees is an insurtech company working to transform the aging-in-place experience for older adults across the U.S. When it comes to hiring, we look for individuals who live out our company values and who have the skills to drive our mission forward, no matter who they are or where they come from.

The Zebra is the nation's leading, independent insurance comparison site. With its dynamic, real-time quote comparison tool, consumers can identify insurance companies with the coverage, service level, and pricing to suit their unique needs. The Zebra compares multiple insurance companies and provides agent support and educational resources to ensure consumers are equipped to make the most informed decisions about their home and auto insurance. Headquartered in Austin, Texas, The Zebra has sought to bring transparency and simplicity to insurance shopping since 2012 — it's "insurance in black and white."

Route gives consumers the power to track all their orders in one place from any merchant. With a Route integration, a consumer is able to carbon neutralize their package with green tracking and green package protection. If any issues arise, users can resolve an order issues within a few taps with resolve. Additionally, Route partners with merchants to turn tracking into a brand-building opportunity, providing a full suite of ecommerce tools that easily integrates into their site, and allows merchants to optimize how their brand is discovered by shoppers worldwide. Learn more at www.route.com

Marsh McLennan (NYSE: MMC) brings together nearly 78,000 experts in risk, strategy, and people across Marsh, Guy Carpenter, Mercer, and Oliver Wyman, serving clients in over 130 countries. Marsh enables enterprise worldwide by helping clients manage risks, transforming uncertainty into opportunity. Guy Carpenter helps clients grow profitably with reinsurance broking expertise, advisory services, and advanced analytics. Mercer helps organizations advance the health, wealth, and careers of their most vital asset — their people. Oliver Wyman’s expertise in strategy, operations, risk, and organization transformation changes what is possible for our clients, their industries, and society. Together, we combine a unique range of capabilities to help our clients solve problems, seize opportunities, and build lasting success in increasingly complex operating environments.

Hippo is modernizing the $100B home insurance industry by putting customers at the center of everything we do, from the coverage we offer to the customer service we provide. Hippo’s true ambition lies in helping people protect their homes to begin with by leveraging technology and data to help find small issues before they become big headaches.

Bright Health Group is defining the future of health care by integrating financing, care delivery, and technology to create a better performing health care experience for consumers. Driving it all is our person-centric, intelligent technology platform which connects consumers, payers, and providers with the common purpose of lowering health care costs.

Cerity is leveraging predictive modeling, advanced analytics, and a modern tech stack to completely transform the way small businesses purchase & manage workers’ compensation insurance. Headquartered in downtown Austin, our vision is to make protecting small businesses across the country simpler, easier, and faster.

We’re on a never-ending journey to change how you think about insurance—again and again. From a pragmatic chore to an opt-in lifestyle, from a transactional relationship to a community of the like-minded. We approach insurance with creativity, continually revisiting, redesigning, and reimagining how it can be a force for better living. We’ve got some new, exciting things in the works that you don’t want to miss, so turn those post notifications on! And– WE’RE HIRING! Our team is quickly growing so keep an eye out for open positions. We’re stoked that you’re here.

As the 11th largest independent insurance brokerage firm in the nation with over 250 offices in 34 states and England, AssuredPartners is committed to partnering with successful regional and local insurance providers that share the same goal: to service customers better than anyone. Powered by AssuredPartners, our partner agencies have the deep network resources, experienced people and carrier relationships to provide products and solutions second to none. We are proud to be recognized by leading industry publications: - Best Places to Work in Insurance (Business Insurance) - Elite Agency (Insurance Business America) - Top Property / Casualty Agencies (Insurance Journal) - 100 Largest Brokers of U.S. Business (Business Insurance) Partnership. Expertise. Innovation. Passion. Doing the Right Thing. Making a Difference. These are some of the traits that define our culture. We provide a deliberate and well defined path for the next generation of Risk Management Professionals, because we're invested in your success – now and for the long run.

Headquartered in sunny Miami, Windhaven® Insurance has written more than $2 billion in auto insurance premium since its founding more than fifteen years ago. With offices in Tampa, Florida, and Dallas, Texas we provide coverage to more than 220,000 policyholders through more than 8,000 local independent agents.

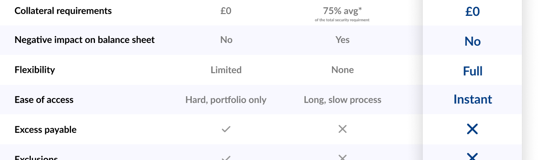

We replace antiquated bank-guaranteed and cash-funded procedures with micro-bonds, which are technology enabled and prudently underwritten micro surety bonds. We're democratising access to the best financial instruments, making payment security work better for suppliers and their buyers.

QuoteWell is a tech-driven wholesale broker delivering a responsive and transparent experience. We are utilizing technology in our submission and marketing processes, which empowers best-in-class in-house brokers to efficiently find and place the risk while allowing retail agents to reduce repetition and not waste time or effort. An example of such technology is our appetite-driven triage backed by artificial intelligence. This intelligent appetite enables QuoteWell's in-house brokers and retail agents to scan carrier appetite data to determine the best market to place the underlying risk. QuoteWell's collaborative tooling reduces the friction typically associated with wholesale brokers, providing retail agents unparalleled responsiveness and transparency. With this data and tooling, QuoteWell can service the best "submit:bind" ratios across the industry and be a differentiated technology and distribution partner to retail agents and carriers alike. QuoteWell is headquartered in Austin, Texas, and has raised over $20M from VCs, including NEA, Goldcrest, and Floating Point. All insurance products are offered by QuoteWell Insurance Services, LLC, NPN #20585132.

Spot is an ambitious startup that shocked the insurance industry by opening an entirely new channel of distribution and targeting those living active and adventurous lifestyles. Spot makes it possible for people to purchase injury insurance at an approachable price through a simple, digital platform. Led by a team that, for the most part, doesn't come from the insurance world, Spot is always pushing the bounds of possibility and breaking down archaic traditions. Get Spot starting at $25/month for up to $20,000 toward your medical bills each time you're injured.

Texas Mutual Insurance Company, the state's leading workers' compensation provider, has a strong foundation of success. We insure 40% of the Texas workers' compensation market, which means that more than 64,000 business owners rely on us to meet the needs of their 1.4 million workers every day.

Work Your Passion. Live Your Purpose.

.jpg)

.jpg)

.png)

.jpg)