Top Austin, TX Fintech Companies (162)

Abroaders helps you save money on flights, by simplifying the earning and using of frequent flyer miles and loyalty points. Our customers save over $900 per passenger on international flights in economy class, and over $3,300 in business/first class.

FinancialForce accelerates business growth with customer-centric ERP, Professional Services Automation (PSA), and Customer Success Operations solutions. Run on the leading cloud platform, Salesforce, FinancialForce enables organizations to see their customers in full color to unlock customer insights, deliver innovative experiences, run a digital business, and achieve agility and resilience. Founded in 2009 and headquartered in San Francisco, FinancialForce is backed by Advent International, Salesforce Ventures, and Technology Crossover Ventures.

Open Lending specializes in loan analytics, risk-based pricing, risk modeling and automated decision technology for automotive lenders throughout the United States. Open Lending’s flagship product, Lenders Protection™, is a unique auto lending enablement platform. It utilizes proprietary data and advanced decisioning analytics to provide lenders with a powerful way to increase near and non-prime auto loan volumes, without adding significant risk to their auto loan portfolio.

It’s time to rethink software development. The world needs more empathy in engineering, collaboration in design, joy in process and focus on delivering value. We takes a human centered approach to software that creates world-class products people love to use.

Ionixx Technologies is a leading IT solutions provider, helping both enterprises and startups to build digital products and solutions at scale. A brand with a design-first approach, Ionixx specializes in Fintech(Digital Brokerage, Post-trade, OMS), Healthtech, and Web3 solutions driven by the transformative power of blockchain, cloud, and AI technologies. With close to a decade of experience, we have helped companies build over 50 successful solutions across the globe. Our primary focus remains on finding the most innovative solution for our clients by leveraging the latest technologies to optimize costs and amplify ROI. We are proud of our diverse and dynamic 250+ member team that has domain experts with a combined experience of over 20+ years. Be it Smart Contract development, UX/UI design and solutions, Fintech, or health tech software, we provide fast, scalable, and reliable solutions. Currently spread across 4 geographies and 6 locations (Austin, New York, Toronto, Dubai, Singapore, Chennai), we look forward to being your technology partner in getting your vision to reality and solving every challenge along the way. Contact us at info@ionixxtech.com, and let’s discuss how we can help you achieve your goals

We are an online consumer lending platform organized around providing superior value and experience for our borrowers. Founded in the summer of 2013 and headquartered in Austin, Texas. We believe in putting our customers first. That means affordable, fixed rate personal loans that are backed by secure technology and friendly service.

CBG Holdings, Inc. is a holding company, which through its subsidiary develops electronic banking software for financial institutions. Its software suite includes integrated modules for online banking, telephone banking, mobile banking, and core account management. CBG Holdings, Inc. was incorporated in 2005 and is based in Austin, Texas.

First Dollar is a tech company that builds flexible infrastructure for health spending benefits. Innovative organizations—from TPAs to banks—use First Dollar's suite of software tools and APIs to launch new offerings and manage lifestyle benefits, pre-tax accounts, rewards programs, and supplemental benefits. First Dollar is based in Austin, with teammates throughout the United States.

Student Loan Genius helps today’s most competitive companies and their employees pursue financial wellness by tackling one of their biggest life hurdles: student loan debt. Inspired by their own personal experiences, the team a complete student loan benefit which helps employees reduce debt and lay the foundation for long-term financial wellness.

Guava is a personal coach for your finances and distributed like a '401k' for low- to mid-income employees. It is a web-application that takes users' financial history and generates an actionable financial plan for them and leads them to financial security. Guava increases employee satisfaction, retention, and -- most importantly -- profits for employers.

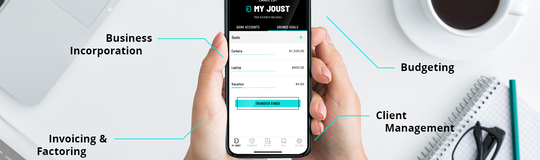

Joust believes the independent professional and the small business founder will drive the future economy. We are on a mission to make managing finances easier for you with a banking platform that offers: a business bank account, an integrated merchant account for card acceptance, and PayArmour, our invoicing feature that guarantees your income.

Paybook, Inc. is an innovative fintech company dedicated to building financial inclusion, increasing efficiency in traditional finance, and unlocking the power of digital technologies like cryptocurrencies. Our suite of products brings transparency and automation to all sectors of Latin America’s financial markets. We are proud to power the open finance revolution. In WWI, British soldiers carried a “pay book” to record their salary payments and as identification. Paybook channeled this concept into an innovative and patented finance management app in 2011. Since then, we’ve built many more exciting modern finance products. Syncfy, our financial API product, helps customers reduce costs and increase efficiency by giving them access to financial data like transactions and account details directly from sources like banks, credit cards, tax authorities, and digital wallets. By connecting to one API, Syncfy customers can also integrate payments and invoice stamping services, saving them the hassle of working with many different contractors and juggling multiple technical solutions. Nothing is more important to donors than understanding how nonprofits are spending their money. Glass, Paybook’s open accounting product, enables nonprofits and charities to publish their finances to the world to boost trust and transparency. Nonprofit organizations can accept donations in fiat and crypto currencies with the Glass widget. Finances, our personal finance app, allows our users to link all of their financial information in one place. By pulling together data from bank accounts, credit cards, payment apps, utilities, and digital wallets, users can get a complete picture of their financial situation, plan for savings, pay down debt, and even apply for credit. Our mission is to bring the power of open finance to underserved communities. If you want to help us build the future of finance, we can’t wait to hear from you!

At Celadonsoft, we develop custom software, offer expert IT consulting, integrate complex systems, and provide cloud and cybersecurity solutions. Our focus is on creating scalable, efficient, and secure applications that help businesses thrive.

Verifi Inc., a Visa company, is an innovative leader in the FinTech industry with payment protection and management solutions for eCommerce merchants. Our SaaS based service is an end-to-end secure technology providing merchants immediate results. We continue to invest in our product suite to ensure we stay ahead of ever-changing payment methods.

Buying a home should be an exciting milestone. But all too often, it’s stressful, especially when you’re buying and selling at the same time. So we’re redesigning the home-buying experience. We’re a fast-paced real estate startup that empowers agents to help homebuyers craft their best offer – so they can buy before they sell, get better terms with a cash offer, and close on time. Founder and CEO Tim Heyl, a 10-year industry veteran and owner of one of the fastest-growing agent teams in the country, started Homeward in 2018. In fact, he bought our first customer’s home with his life savings. His idea has evolved into our Homeward Offer. It’s more than an offer; it’s the power to buy a new home on your terms. It’s the convenience that keeps you from moving twice. And it’s the savings that come from having everything you need in one place. We’ve raised more than $160MM in equity capital from top-tier venture investors, including Norwest, Blackstone Alternative Asset Management, Adams Street, Javelin, and LiveOak. Our leadership team includes real estate, mortgage, and technology experts.

The Liveoak cloud platform seamlessly integrates best-in-class video conferencing, screen-sharing and data/ID capture with forms collaboration and e-signature capabilities that let your teams deliver white-glove service to your customers. We help enterprises close more business and eliminate nearly all “not in good order” paperwork.

People love to buy. However, they hate to be sold. So, we don't sell you the provider. We provide you a solution to increase your sales. We have stopped selling a while ago, and since that, we started helping. Should you need a dedicated team of developers for your ongoing or upcoming projects, please do not hesitate to contact VironIT. And what's important: we are not B2B, and not even B2C, but we are H2H. That means HUMAN TO HUMAN. So, while some offer you products, others – services, we offer you the two most valuable things on this Planet, i.e. TIME and BRAINPOWER. VironIT is a software development company providing comprehensive professional software development services (mobile app development, web-oriented software products and business software solutions), software integration and updating, support and maintenance of developed apps. The company was established in 2004, and since then has reinforced its position in the IT market, and is constantly mastering the latest IT technologies.

Reporting and advice that caregivers and seniors trust to safeguard money.

Mr. Presta is a financial technology company that develops tools to enable small business lending in Emerging Markets.

Realized is a wealth tech company that provides wealth-management solutions for real estate investors. We strive to make it easy to transform individual property assets into investment property wealth solutions tailored to each investor’s needs and vision for the future. We help investors exchange individual properties for diversified portfolios, customized to their shifting income needs, risk appetite, and investment goals.

.jpg)

.png)

.png)