Top Tech Companies (230)

Don't see your company?

Create a company profileTSYS is now a Global Payments company. Together, we’re delivering unrivaled payments expertise to our customers globally.

FinancialForce accelerates business growth with customer-centric ERP, Professional Services Automation (PSA), and Customer Success Operations solutions. Run on the leading cloud platform, Salesforce, FinancialForce enables organizations to see their customers in full color to unlock customer insights, deliver innovative experiences, run a digital business, and achieve agility and resilience. Founded in 2009 and headquartered in San Francisco, FinancialForce is backed by Advent International, Salesforce Ventures, and Technology Crossover Ventures.

Billsley (formerly OnePay) is a bill payment and savings optimization platform. We take a look at your monthly bills and find out if there are ways you could be saving.

CollBox solves the $800B / year problem of past-due invoices. We help small businesses get paid for their work by empowering them to send past-due receivables straight from their accounting books to an ethical, effective debt collector in just three clicks.

We’re Tend, the world's first neobank powered by the social engine of its membership. We exist to create financial wellbeing together, empowering our community to build the next generation of financial services with us. Our interactive platform will be launching in the U.S. and Mexico in 2Q21, beginning with a mobile banking app that comes with all the good stuff and none of the headaches of other financial institutions. A Tend membership means access to amazing perks and rewards, like up to 15% cashback on everyday shopping, up to 10% cashback on travel, a referral program that pays you monthly (you heard that right), and much much more. Need to transfer money? You got it. Build your credit? Yep. Send money abroad? We’ve got you covered.

CrowdOut offers profitable, middle market and lower middle market companies a better way to raise capital. We partner with leading credit funds to underwrite and fund loans while offering accredited investors the opportunity to earn 7%–12% yields from investments as low as $1,000.

EarthBenign is an end to end community supported trading platform for supply chain management. Our financial solution is an asset-backed billed vouchers built for the massively scaled community supported farm to fork supply chain ecosystem that enables bottom layer producers like farmers get instant microfinancing.

In a rapidly digitalising economy, the number one risk is fraud. SEON was born from the need for a better anti-fraud system. One that allows online businesses to accept more transactions safely while protecting consumers. Over 5000 merchants globally already agree with us, and we are well on our way to expand globally. Joining us means working with the latest technologies and methodologies, supporting globally recognised digital brands. As we expand our operations globally in a year of rapid growth, you will also face challenges and gain experience that cannot be gained elsewhere. We are young and energetic, focused and determined at work, but our attitude is laid back. We want to meet our goals together so we support each other even if we face unfamiliar situations which are not uncommon in a rapidly changing environment.

SQUIRE is the world’s leading and fastest-growing software technology platform for barbershops, a hundred-billion-dollar global industry. We provide a one-stop solution that helps small business entrepreneurs run and grow their businesses. SQUIRE is also the premiere booking engine that connects people with great barbers nationwide. We make it easy to discover and book the best barbers wherever you are, in just a few taps. With headquarters in New York and a presence in major cities in the United States, U.K. and Canada, SQUIRE is the market leader in technology solutions for the barbershop industry. SQUIRE is a Series D company and has raised over $165M to date. For more information, please visit getSquire.com or download the SQUIRE app from the App or Play Store.

Green Dot is a financial technology and registered bank holding company committed to delivering trusted, best-in-class money management and payment solutions to customers and partners, seamlessly connecting people to their money. Green Dot’s proprietary technology enables it to build products and features that address the most pressing financial challenges of consumers and businesses, transforming the way they manage and move money and making financial empowerment more accessible for all. Green Dot offers a broad set of financial services to consumers and businesses including debit, checking, credit, prepaid, and payroll cards, as well as robust money processing services, tax refunds, cash deposits and disbursements. Its flagship digital banking platform GO2bank offers consumers simple and accessible mobile banking designed to help improve financial health over time. The company’s banking platform services business enables a growing list of the world’s largest and most trusted consumer and technology brands to deploy customized, seamless, value-driven money management solutions for their customers. Founded in 1999, Green Dot has served more than 33 million customers directly and many millions more through its partners. The Green Dot Network of more than 90,000 retail distribution locations nationwide, more than all remaining bank branches in the U.S. combined, enables it to operate primarily as a “branchless bank.” Green Dot Bank is a subsidiary of Green Dot Corporation and member of the FDIC .

Insurance needs to adapt to changing customers, changing risks, and changing industries. Assurely was built specifically for this need. Assurely’s technology-first model allows for new insurance products to be created fast and delivered digitally, solving a significant problem for both customers and the entire insurance industry.

Invoiced helps companies get paid faster, waste less time on collections and provide a better customer experience. With more than 20,000 customers and more than $40 billion in receivables processed, Invoiced is pioneering the field of Accounts Receivable Automation.

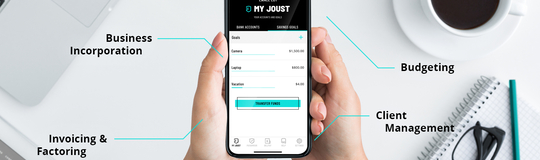

Joust believes the independent professional and the small business founder will drive the future economy. We are on a mission to make managing finances easier for you with a banking platform that offers: a business bank account, an integrated merchant account for card acceptance, and PayArmour, our invoicing feature that guarantees your income.

Our mission is to positively impact people's lives financially by moving billions of inefficient advertising dollars to millions of people. We offer shoppers cash back on everyday purchases and partner with brands to offer highly accountable transaction-based incentives to drive acquisition, retention, and loyalty.

Digital bank for small businesses in the home building and renovation industry.

Able is the world's first collaborative lender. We can fund any small businesses through collaborative loans, providing growth capital to entrepreneurs through the support of their networks and ours. Able. More than a loan.

9W is an innovative search service designed with one simple idea in mind - the single, right answer to a financial question delivered to you in seconds, to your device of choice, wherever you are and whenever you need it. 9W has the most complete, timely and accurate US public company financial data available anywhere. Unlike financial search engines which force you to comb through incomprehensible amounts of online data, 9W Search financial expertise is built into the application. 9W Search lets you access this information through pre-selected metrics. Instead of culling through the large amounts of company data filed with the SEC, the 9W Search team has done the work for you by letting you choose from extremely valuable metrics. Future development will include additional industry data and global information. Fully integrated with social media platforms including Facebook, LinkedIn and Twitter, 9W results and reports can be easily shared. Development on 9W Search continues as we add new features including a Screener, Portfolio option, pick lists and industry taxonomies. Based in Austin, Texas, the 9W Search global team provides comprehensive coverage of issues, ongoing research and development and support.

INK is a mid-sized marketing and public relations agency working with technology and energy companies that are cultivating a healthier planet, building a smarter, more inclusive economy, and empowering people to solve the world's toughest challenges. Our mission, good work with good people makes for a good life, starts with a commitment to continuous learning and a supportive culture. Every day, we aspire to do work we're proud of, find new and better solutions, and evolve our thinking. We are a woman-owned business and an equal opportunity employer that welcomes everyone to the team. We strongly encourage people of color, LGBTQ+ and non-binary people, veterans, and individuals with disabilities to apply. We are a hybrid workplace (30% monthly time in office; 70% remote) with office destinations in Austin and Denver and a collaborative team spread across North America. The INK agency experience is different by design. You will be part of an integrated communications team that unites public relations, content, digital, and other creative disciplines to generate bigger impact. You will enjoy a culture of flexibility and trust, with the autonomy to do your best work and the support of a team that has your back and holds each other accountable. You will work with clients who understand the value of communications and appreciate the unique partnership and perspective INK brings. Not only are you encouraged to participate in team building, new business, and generous holiday schedules and PTO, you are given time and support to do so. We fund peer-to-peer spot bonuses, a health and wellness program, and a highly competitive benefits package. INK has won numerous industry and best places to work awards, including the 2024 PR News' Elite Top 100 and Inc Magazine’s Power Partners and Best Places to Work for 2023. Learn more at www.ink-co.com.

WayWiser is a mission-driven startup with the goal of protecting the independence and dignity of people as they experience the later years of life. Founded in 2019 by a team of people who have all experienced watching a loved one get scammed or exploited, WayWiser makes it easier for older adults to get connected and stay protected by offering a comprehensive platform focused on bringing families together and helping them maintain their independence and freedom.

Imagine online marketing from your loan officer or realtor that doesn't suck. Homebot is an automated marketing service for mortgage lenders and real estate companies that delivers 5X conversion rates by empowering consumers with an intelligent “wealth building” portal for their home. We're also a recent graduate of the 500 Startups accelerator!

.jpg)

.jpg)

.jpg)