Full article and analysis below infographic

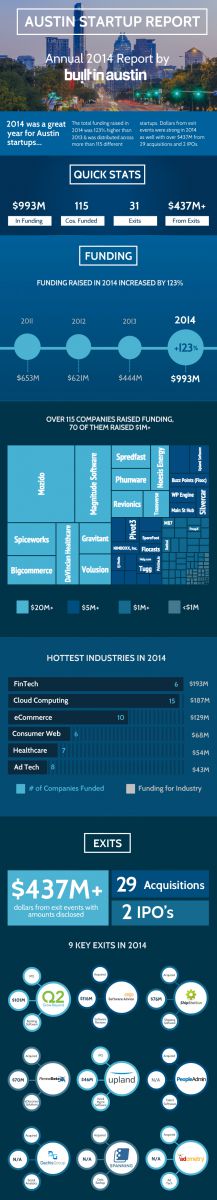

Investors significantly increased their bets on Austin digital technology companies in 2014, funding 115 startups and buying up 31. In total, over $993 million was invested and over $437 million was spent on digital tech companies in Austin. Those funding totals increased 123 percent over 2013, according to a comparison of

Built In Austin data to historical data from Thomson Reuters.*

Financial technology, cloud computing, e-commerce, consumer web, healthcare and advertising technology companies were the industry's most highly and most often funded. Those industries are mostly business-to-business, which is in line with Austin's historical record of success with enterprise software.

"SaaS plus data science plus enterprises: this last year has seen a number of interesting startups, like PivotFreight, beginning to target enterprises with solutions that pair the SaaS-ification of traditionally-spreadsheet-driven businesses with data science," said Brian Dainton, founder and VP of engineering at Mass Relevance, an enterprise SaaS company that was acquired in early 2014.

In 2014, several notable funding rounds going to enterprise businesses were: BigCommerce, an e-commerce platform, which raised $50 million, Davincian Healthcare, a healthcare analytics company, which raised $50 million, Magnitude, an enterprise information management software company, which raised $100 million, and Mozido, a mobile bill pay platform, which raised $185 million.

The lion's share of exits went to enterprise businesses as well. Several notable exits were: Shipstation, a SaaS shipment process platform company, which sold for $76 million, RenewData, a legal analysis platform, which sold for $70 million, and Upland, a work management software company, which sold for $46 million.

Austin tech is increasingly well-known nationwide

Austin’s investment and exit growth comes as the city is increasingly viewed as a legitimate tech hub for entrepreneurs, investors and tech professionals. Well-known events like South By Southwest, major tech company successes like

Indeed,

HomeAway and

RetailMeNot and a growing entrepreneurial support system, built around institutions like the University of Texas,

Capital Factory,

Techstars and the

Austin Technology Council, have helped raise the city’s profile in the eyes of outsiders.

Brett Hurt, for example, founder and former CEO of

Bazaarvoice, an Austin-based ratings and reviews software company, in 2005, moved from the San Francisco Bay-area and has seen Austin tech culture change dramatically.

“I’ve never seen this amount of startup activity in Austin,” said Hurt. “People are thinking big; they are creating really big disruptive businesses that are every bit as good as Silicon Valley.”

A lot of that startup activity can be traced to efforts, over a decade ago, by the tech community to meet up and organize itself. For example, when Hurt landed in Austin from San Francisco in the early 2000’s, he went looking for other entrepreneurs. He found them in

Bootstrap Austin, a group organized by a former Trilogy Software employee name Bijoy Goswami. That group brought together many of Austin’s prominent entrepreneurs before there wasn’t an established system of support.

“That’s where I got to know

Josh Baer and

Eric Simone,” said Hurt. “Eric was my first investor for Bazaarvoice.”

Josh Baer would go on to sell his company SKYLIST and start Capital Factory and Eric Simone began successful tech company ClearBlade and is now an active angel investor. For his part, Hurt IPO’d Bazaarvoice, now angel invests in Austin tech companies and his former Bazaarvoice employees have gone on to found 22 new companies of their own.

“There is a ripple effect to these things,” said Hurt.

Tiny ripples to big waves

Ripples started in Austin over a decade ago now have reached across the country. Those ripples are coming back as waves and are bringing investors and entrepreneurs.

“What is really interesting is the amount of people moving here and doing their second startup,” said Steve Welch, founding partner of accelerator

DreamIt Ventures. “In a lot of ways the people who are coming in from the outside with experience are benefiting first time entrepreneurs.”

DreamIt Ventures was originally headquartered in Philadelphia, Pennsylvania, but Welch and the company have now split its operations between Philadelphia and Austin. Welsh said part of the decision to do that was based on Austin’s booming tech community and the region’s warmer climate.

Welch’s move is not uncommon. Many older entrepreneurs who cut their teeth during the early days of the Internet in San Francisco, see life in Austin as a more affordable option, and the tech scene is just as exciting.

To be a successful tech entrepreneur, “do you have to be in Northern California? No,” said Paul O’Brien, chief marketing officer for venture capital firm

MicroVentures, who moved his family from the San Francisco Bay area. “We are attracting a lot more talent and a lot more interest from professionals who are helping accelerate things.”

The effect is to make Austin even more appetizing for investors. “Migration is turning the attention of investors around the world to Central Texas,” said O’Brien.

When investors and entrepreneurs arrive in Austin their efforts and money are quickly supported by a growing startup support network.

"Austin’s startup scene has exploded tremendously, and the set of resources to foster this growth has likewise grown dramatically," said Dainton of Mass Relevance. "We now are home to world-class accelerators and incubators, collaborative workspaces, and a ton of great entrepreneurial events."

Accelerators like Capital Factory and Techstars, institutions like the University of Texas and the Austin Technology Council, and new coworking spots like WeWork and Link, all are helping to improve the performance of entrepreneurs. Investors see this network and they know that their money is not only being cared for by one founder, but a whole community of founders.

"It’s a unique community in the fact that everyone plays and works together so well," said Welch. "It feels open and welcome to the outsiders coming in. I'm not sure other communities feel that way."

*Thomson Reuters data totals include fundings that Built In Austin's intentionally excludes (see below)

**Sources: SEC filings, press releases and confirmed news reports (amongst other public information)

***Digital tech companies counted only. Computer hardware and electronics excluded.